Being a successful financial adviser isn’t just a numbers game. As 2024 unfolds, advisers / IFAs need to blend traditional wisdom with innovative lead generation strategies to stay ahead in the game.

This guide will explore 17 proven lead generation strategies for financial advisers. From the power of Google Maps to the more old-fashioned tactics, we’ll outline everything you need to do to expand your network and help you learn how to get leads as a financial adviser.

Ready to redefine your client-acquisition approach as an IFA and bring in more financial leads? Let’s dive in.

Table of Contents

1. Get On Social Media

Social media platforms are a goldmine for leads for financial advisers. If you’re not already leveraging organic social media, you’re missing out.

Start by identifying where your potential clients hang out online. LinkedIn is almost certainly going to be your best bet as an IFA / financial adviser.

LinkedIn is brimming with professionals who are in the right stage of their careers to appreciate and seek guidance.

Start by giving your profile a thorough polish. Ensure your photo and summary reflect your professionalism and expertise. Regularly sharing articles, insights, and quick financial tips helps establish you as a knowledgeable authority in the financial sector. And don’t just post and ghost!

Engaging with others’ content, answering questions, and contributing to discussions about financial planning, investments, and market trends can significantly boost your visibility.

Remember, consistency is key in social media. Aim to consistently share fresh content, promptly address any feedback and become part of the dialogue!

Use social media to establish yourself as a thought leader in your field. Share useful financial tips, interesting articles, and your thoughts on financial trends.

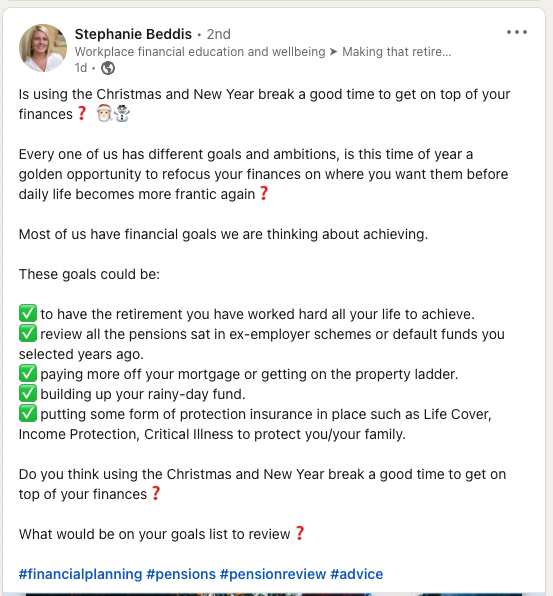

2. Revamp Your Landing Page

It’s key to create a financial adviser landing page that not only grabs your users’ attention but also converts – the art of conversion rate optimization (CRO).

Your landing page needs to effectively showcase your expertise and trustworthiness as a financial adviser – whilst nudging visitors towards scheduling a consultation or seeking more information.

A stellar landing page for financial advisers is clear and concise, highlighting the key aspects of your advisory services. Maybe this includes your specialisation in specific investment areas, your experience, personalised financial planning approaches – or your track record of success with clients.

You should include eye-catching headlines, compelling content, engaging visuals representing financial growth or client interactions, and clear call-to-actions to enhance the effectiveness of your landing page.

Adding testimonials from satisfied clients, any certifications or awards you’ve received, and affiliations with financial bodies will significantly boost your credibility.

Examples of header text could be: “Secure Your Financial Future with Expert Advice”, “Personalised Financial Planning for Your Unique Goals”, or “Trusted Financial Guidance for Peace of Mind”.

You’ll need to ensure your landing page is mobile-friendly – a huge proportion of users will be on their phones, so don’t ignore them!

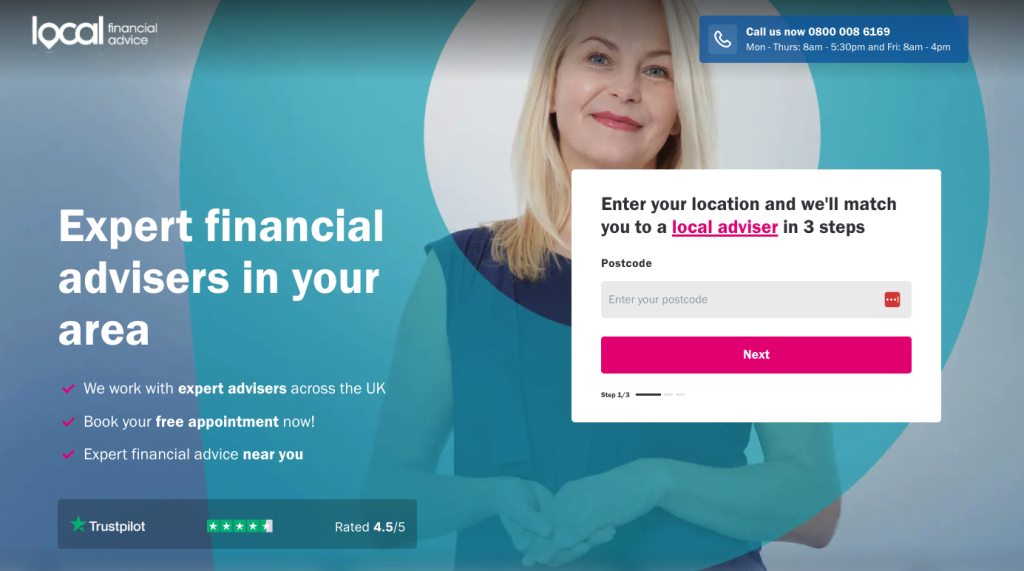

3. Get Seen With Google My Business

If you haven’t already, set up a Google My Business profile. This is a free tool that allows you to promote your Business Profile and business website on Google Search and Maps. It’s a fantastic way to increase your visibility and attract local leads.

When you’re easily discoverable in local searches, it leads to more enquiries and potential client interactions. Once you’re searchable on Google Maps and other areas of Google, you should start to notice more financial advice leads coming in.

Your Google My Business profile also acts as a direct line of communication with potential clients. It allows you to share vital information – your working hours, contact details, and the rest. More than just facts, this information builds a narrative about your reliability and professionalism.

Perhaps the most significant advantage is the trust factor. Client reviews on your profile can immensely bolster your credibility. These reviews often play a crucial role in influencing new clients, showcasing real-world examples of your expertise and client satisfaction.

4. Start Email Marketing

Making use of email marketing is a savvy move for IFAs and financial advisers looking to generate leads.

The first step is building a robust email list, and a smart way to do this is by leveraging your website. Offer a compelling resource for free – it could be an insightful guide on retirement planning, tax-saving strategies, or investment tips – in exchange for visitors’ email addresses.

This approach not only helps in list building but also sets the tone for the kind of value you’ll be offering.

Once your email list starts growing, you should engage with your subscribers regularly. Send out newsletters that are more than just a sales pitch. For instance, share insights on recent financial trends, offer practical advice on managing finances in uncertain times, or decode complex financial concepts. You could also highlight case studies where your advice helped clients achieve their financial goals. This content should not only inform but also reassure your subscribers that you understand their financial needs and challenges.

Don’t forget, not so much about plugging your service as providing genuinely useful information. This not only builds credibility but also establishes a rapport with potential clients – they’re more likely to turn to you when they need financial advice because you’ve already demonstrated your expertise.

Regularly reviewing and refining your email content based on subscriber feedback and engagement metrics is also crucial. This ensures that your emails remain relevant, engaging, and effective in converting leads into clients.

5. Attend Networking Events

Networking events are a vital tool for IFAs and financial advisers. These can range from industry-specific conferences to local business events or community gatherings.

Your elevator pitch at these events is key. It needs to be concise, highlighting your unique approach or a specific expertise – whether that’s retirement planning or high-net-worth individuals. This approach will spark interest and pave the way for deeper conversations.

Business cards are more than just contact information; they’re a physical reminder of your interaction. Make yours stand out with a memorable tagline or a QR code linking to your professional website.

Engaging in meaningful conversations is crucial. Discuss current financial trends, share insights on investment strategies, or talk about the challenges of financial planning in today’s economy. This not only showcases your knowledge but also helps in identifying the specific needs of potential clients.

Remember, the follow-up after these events is as important as the interaction itself. Reach out with a personalised email or a LinkedIn connection to show genuine interest and keep yourself at the forefront of their minds for financial advice.

6. Set Up A Referral Scheme

Referrals can be a fantastic way to generate quality leads for IFAs and financial advisers. If you haven’t already, consider setting up a referral program. This can be a powerful tool, as referrals often come with a level of trust and credibility that cold leads don’t.

You should consider offering incentives for referrals. This could be a discount on your services for both the referrer and the new client, creating a win-win situation. Alternatively, a small, thoughtful gift as a token of appreciation can go a long way in showing your gratitude.

Think about what would be most appealing to your clientele – perhaps a gift card to a popular restaurant or an exclusive financial planning resource.

Make sure your existing clients are well-informed about your referral program. Incorporate information about it in your regular communication channels. For instance, mention it in your email newsletters, adding a specific section that outlines the benefits of referring new clients. On your website, consider having a dedicated page for the referral scheme, making it easy for clients to find and understand the process.

7. Host A Webinar

Webinars and workshops can be a very powerful strategy to attract targeted financial adviser leads and showcase your expertise.

Consider topics that are both timely and relevant to your target audience. For instance, you could host a webinar on ‘Navigating Market Volatility – Strategies for Long-Term Investors’ or conduct a workshop on ‘Effective Retirement Planning in Your 40s and 50s’.

These topics address common financial concerns and can attract a wide range of potential clients.

Promotion is key to the success of these events. Use your website to its fullest by creating a dedicated events page where visitors can find details and register for upcoming webinars and workshops. This page should be easily accessible, perhaps even featuring on your homepage for maximum visibility.

Leverage your social media platforms to generate buzz around your events. Create engaging posts that highlight the value of the webinar or workshop and encourage your followers to share these posts. You can even consider boosting your posts with paid social media advertising.

Encourage attendees to sign up with their email addresses, which serves two purposes: it helps you gauge interest and manage the event effectively and provides you with a means to follow up with attendees after the event.

Post-event follow-up is crucial – send out a thank you email, include key takeaways from the event, and perhaps offer one-on-one consultations to discuss individual financial planning needs.

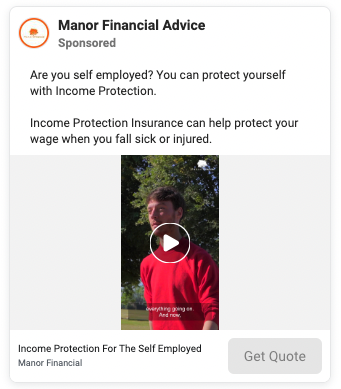

8. Try Facebook Ads

Facebook ads can be a game changer for financial advisers, and offers a scalable way to bring in financial advice leads.

The key is to craft ads that resonate with your target audience. Imagine you’re scrolling through social media and a Facebook ad pops up saying, “Worried About Your Retirement Savings? Let’s Talk!” It’s clear, direct, and addresses a common concern. This kind of header grabs attention and speaks directly to the audience’s pain points.

Another vital aspect is the offer. You could try something like, “Free 30-Minute Financial Health Check!” This kind of offer is enticing because it’s risk-free and promises value. People love getting something for nothing, and a free consultation is a great way to introduce your services without making a hard sell.

But how do you know what works? That’s where the Facebook Ads Library comes in. It’s a fantastic resource that lets you see what kinds of ads other financial advisers are running. By seeing real-life examples, you can get a sense of what kind of messaging and offers resonate with audiences.

Remember to create engaging ads with compelling copy and visuals. Include a clear call to action (CTA) that encourages users to take the next step, whether that’s visiting your website or scheduling a consultation.

9. Influencer Partnerships

Influencer partnerships aren’t commonly seen in the financial adviser lead generation world, but they can work brilliantly when pulled off correctly. The idea is to leverage the trust and engagement that influencers have built with their audience.

Think of it this way: when a respected influencer talks about how a financial adviser helped them navigate the complex world of investments or retirement planning, their followers are likely to take notice.

A good starting point is to look for influencers whose audience aligns with your target demographic. For example, if you’re focusing on young professionals, an influencer who discusses career growth or personal development might be a perfect fit. The key is relevance. Your services should feel like a natural extension of what the influencer talks about.

The partnership could involve various formats. Perhaps the influencer could share a personal story about how they’ve benefited from your advice, weaving in a call-to-action like, “Schedule your free financial health check with [Your Name] today!” Alternatively, they could host a Q&A session with you on their platform, discussing common financial challenges and solutions.

Remember, authenticity is crucial. The influencer’s audience should feel that the recommendation is genuine and not just a paid endorsement. This sincerity will reflect positively on your services and can significantly boost your credibility and reach.

10. Go Back To Direct Mail Marketing

In the digital age, direct mail marketing might seem old-fashioned. But it can still be highly effective. Consider sending out personalized letters or postcards to potential leads in your local area.

Remember to include a strong CTA in your direct mail pieces. This could be inviting recipients to schedule a free consultation, attend a workshop, or visit your website for more information.

11. Partner With Local Businesses

Partnerships with local businesses can be a win-win situation and can get you highly targeted, high-quality IFA leads. These partnerships can let you engage with a broader audience while simultaneously providing value to your partners and their clientele. The beauty of these partnerships lies in the mutual benefits and the ability to tap into that already established trust.

Imagine aligning with a local real estate agency. Here, you can offer financial planning services tailored to new homeowners or those looking to invest in property. It’s a natural fit – people dealing with property are often in need of financial advice. Your services become an added value to the agency’s offerings, enhancing their customer experience and your visibility.

Similarly, you could establish a referral system with an accountancy firm. In this arrangement, they refer clients who need investment advice or retirement planning, and in turn, you might refer clients back to them for specialised tax advice or accounting services. This symbiotic relationship benefits both parties: the accountants can offer a more comprehensive service package, and you gain access to a pool of potential clients who already understand the value of professional financial guidance.

These partnerships should be more than just transactional; they should be about building relationships. By integrating your services with local businesses, you’re not just reaching new potential clients; you’re embedding yourself into the community. It’s about creating a network where everyone involved – you, the local business, and the clients – benefit from the collaboration.

12. Start Cold Calling

Cold calling can seem like a daunting task, especially for financial advisers just starting out. But, with the right approach and a bit of practice, it can be an effective way to bring in more IFA leads.

First things first, you’ll need a list of potential clients. This could include individuals who’ve recently started their own business, people approaching retirement age, or even young professionals looking to invest for the first time. These are all groups who might need financial advice but haven’t yet sought it out. There are various places to buy these lists online.

When making that first call, remember it’s all about the approach. Start with a friendly introduction, briefly explaining who you are and why you’re calling. For example, “Hello, I’m Alex from XYZ Financial Services. I’ve noticed you’ve recently started a business, and I wanted to reach out to see if you might need any help with financial planning or investment strategies.”

Then, it’s key to listen. Give the person on the other end a chance to talk about their financial goals or concerns. This not only helps build rapport but also gives you valuable insight into how you can tailor your services to their needs.

Don’t be too pushy. If they’re not interested, politely thank them for their time and move on. But, if they are interested, this is your chance to shine. Explain briefly how your services can benefit them, perhaps by mentioning a similar client you’ve helped in the past.

Lastly, always end the call by asking if they’d be interested in a more detailed conversation, either over the phone or in person. This keeps the door open for future interaction and is a gentle way to guide them towards becoming a client.

13. Host Financial Literacy Seminars

Webinars are an excellent way for financial advisers to connect with potential clients, particularly by exploring topics relevant to different audiences. For instance, a webinar titled “Navigating Insurance for Entrepreneurs” can address the specific needs of small business owners, discussing how insurance integrates into their overall financial strategy.

Another topic, “Retirement Readiness” could appeal to those nearing retirement, focusing on how to secure financial stability and where estate planning fits in.

Collaborating with local business networks or retirement communities could expand the audience and bring diverse viewpoints to these discussions. Interactive Q&A sessions add value by directly addressing attendees’ concerns, making webinars a more engaging and informative experience.

14. Create an Online Course

Creating an online course requires a lot of work, but it can be a really good way to get leads. For example, you could create a course on a topic related to financial planning, such as budgeting or investing.

You could promote your course on your website, social media platforms, or email newsletter.

15. Buy Financial Adviser Leads

If you’re struggling to generate leads organically, consider buying financial adviser leads from lead generation services. There are many companies out there that sell leads, but be careful. You want to ensure the leads are high-quality and relevant to your business.

Research the company, check reviews, and ask for a sample of their leads. Make sure you understand their pricing structure and what you’re getting for your money.

When buying leads, it’s important to keep an eye on those numbers so you know what the cost per lead and the cost per appointment is!

Although we can’t personally vouch for these companies, during our research, we found the following companies that allow you to buy adviser leads: Paladin Digital Marketing and Cleverly.

16. Sponsor Local Events Or Teams

Sponsoring local sports teams, events or clubs is a fantastic way to increase your visibility and show your support for the community. This would mainly be considered a brand-building activity, but it can attract financial advice leads too.

Choose a team or club that aligns with your target demographic. Make sure your sponsorship includes some form of visibility, like your logo on team jerseys or banners at events.

17. Leverage Client Testimonials

Client testimonials are a powerful way to build trust and attract leads. If your clients are happy with your services, ask them to provide a testimonial. You can use these testimonials on your website, social media platforms, and marketing materials.

Remember, authenticity is key. Don’t be tempted to fake testimonials or alter them in any way. Prospective clients will appreciate the honesty and authenticity of real, unedited testimonials.

18. Get More Leads With Growform

In the competitive world of financial advice lead generation, every website visit is a potential lead.

But with shortening attention spans and mobile screen-time on the rise, you’re competing for your users’ attention more than ever.

A long, boring form that asks for too much information upfront quickly turns users away, hammering your lead volume and wasting your ad spend in the process.

This is where Growform steps in:

Growform isn’t just another form builder – it was built from the ground for lead generation. It uses conversion rate optimization best-practices, UX research and psychological principles to get you more leads.

With Growform, your users are never greeted with a boring wall of questions.

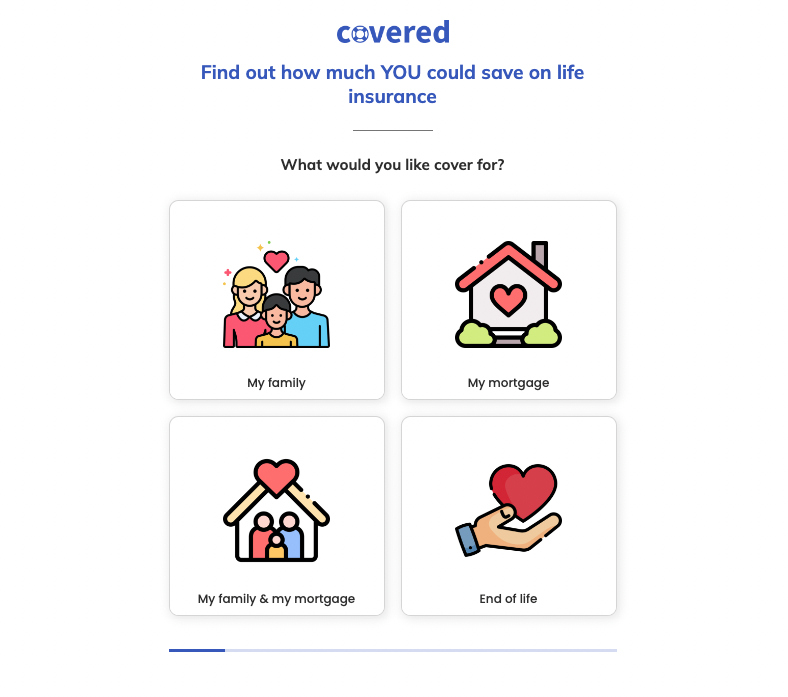

For example, here’s what a Growform form for a life insurance company looks like:

By splitting up questions onto multiple steps and asking them in an engaging way, you’ll be on the way to capturing twice as many leads from the same traffic.

It’s easy to embed a Growform form into any page of your website, and the tool can send leads pretty much anywhere via Zapier.

Financial advisers and lead generation experts worldwide use Growform to squeeze more leads from their landing pages, qualify their leads better and keep track of what’s working. Try a 14 day free trial, with no credit card required!