In the life insurance sector, success is more than just knowing the ins and outs of policies. If you’re an agent wanting to keep your game strong, having a strategy for generating life insurance leads is pretty much non-negotiable.

As 2024 brings new hurdles, agents must get creative with their limited budgets to draw in and keep potential clients.

Modern life insurance lead generation is all about creativity and efficiency – so here are 16 up to date ways you can can generate life insurance leads in 2024.

Table of Contents

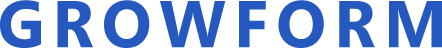

1. Dive Into Social

Social media can be a treasure trove of life insurance leads, and offers a more intimate and direct way to engage with potential customers.

Platforms like Facebook and Instagram are ideal for sharing educational material. Consider posting snappy infographics or bite-sized videos that break down life insurance policies or simplify insurance jargon. Spotlighting real stories of how your life insurance came through for customers in rough times both shows the practical perks and forges a deeper bond with your audience.

Keep your finger on the pulse of all things related to life insurance, including new trends and hot topics. Life insurance trends keep changing, so stay updated. Doing this not only puts your skills on display, but it also keeps you in the loop with industry chatter.

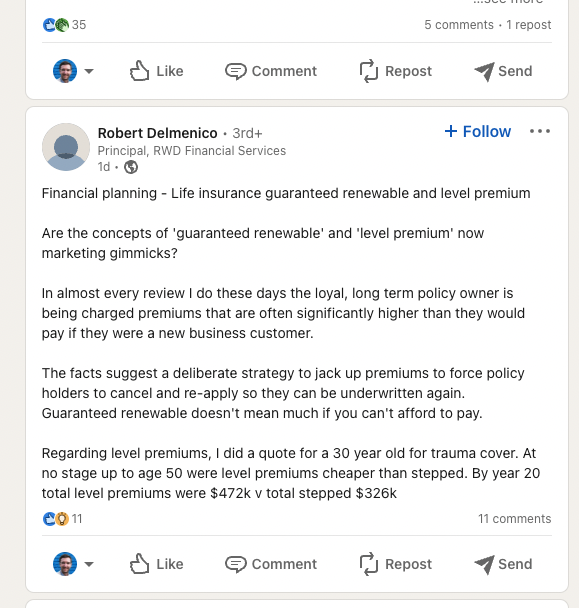

LinkedIn’s focus on industry insights makes it a great place for businesses to share in-depth expertise, and can let you differentiate yourself through thought leadership. You should aim to keep a steady stream of well-thought-out, enlightening articles coming that amp up your reputation and attract more customers, turning you into the go-to pro in the life insurance game.

Engagement is important here. Actively respond to comments and messages and participate in relevant discussions. Engaging this way shows you’re not just another company, but a relatable and dependable figure in the life insurance industry.

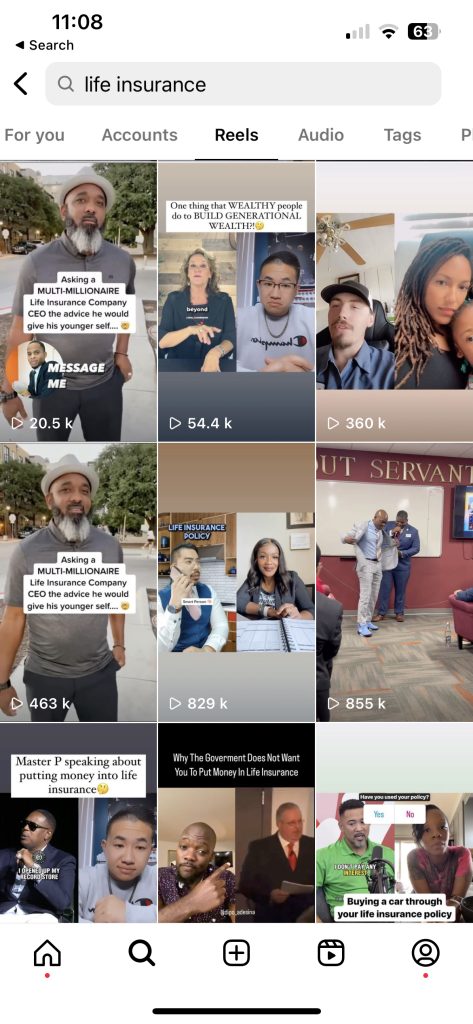

2. Try Facebook / Meta Ads

Facebook Ads is a solid choice for life insurance lead generation and can significantly scale up your business.

To get this underway, start by ensuring your ad campaigns are aiming for conversions, not just brand awareness or reach. Lead your potential clients to a specially crafted page on your website, designed to flip visitors into promising leads. Your landing page should be full of captivating and useful information, selling the benefits of your services.

Kicking off with an eye-catching promotional deal can get you started on the right foot. Consider offers like a discount on the first month’s premium or complimentary consultations to draw attention.

It’s also vital to conduct split tests on various ad creatives to identify which resonates most with your audience. Integrating authenticity into your ads by featuring real customers, yourself, or your team can enhance trust and relatability and turn clicks into leads.

Employing psychological strategies in your ads, such as creating a sense of exclusivity or urgency, can be highly effective. For those just starting with Facebook advertising, begin by targeting demographics most likely to need life insurance, like middle-aged individuals or parents, using Facebook’s precise targeting tools.

As you collect data from your successful ads, broaden your scope by targeting those similar to your converting audience with Lookalike audiences. This will help you capture more life insurance leads on an automated, scalable basis.

Finally, don’t overlook the Facebook Ads Library. This tool gives you a deep dive into various sectors, like life insurance, showing what’s working and the current trends.

3. Start Content Marketing

Content marketing and thought leadership can be great ways of attracting more life insurance leads and becoming a well-known, reputable source of information.

To attract more life insurance clients, you should aim to create relatable, real-life content that speaks directly to potential customers’ needs and concerns—for example, blog posts like “How Young Families Can Pick the Right Life Insurance” which use case studies and concrete examples. Write blog posts or articles tackling topics like “Choosing the Right Life Insurance for Young Families” or “The Role of Life Insurance in Financial Planning.”

These should be relatable and could include real-life examples or client stories. Videos or webinars explaining life insurance concepts in simple terms can also be highly effective, catering to those who prefer more visual or auditory learning.

For the distribution of your content, focus on platforms where your target audience is most likely to engage. Your own website is a prime spot for hosting this content, so make sure it’s optimised to appear in relevant searches. Social media platforms like LinkedIn and Facebook are valuable too, with LinkedIn being ideal for reaching professionals and Facebook offering targeted advertising options.

By guest blogging on money management sites or neighborhood pages, you can widen your reach without blowing your budget on an overpriced celeb spokesperson or social campaigns. By strategically placing your content on these platforms, you’re more likely to connect with a broader audience, leading to more leads and a growing client base.

Keep in mind, your content should not just revolve around life insurance, it also needs to tackle the frequent questions and worries that click with your readers.

Equally important is the technical side of SEO. You’ve got to ensure your site is not just easy to navigate and snappy on load times, but that it loads easily on mobile devices. Search engines love sites that are a breeze to scan and index, and having a phone-friendly site is super important given the growing number of users browsing the web on their mobiles.

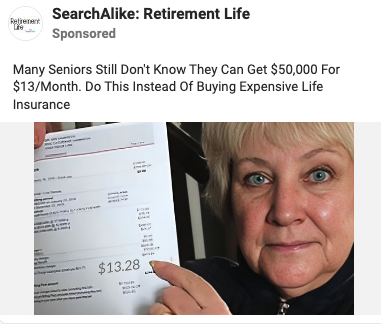

4. Harness Email Marketing

Email marketing can be a powerful tool if you’re looking to convert old prospects into new life insurance leads. Staying in touch through regular emails helps your audience remember you.

The key is to provide value in each email, whether it’s through informative content about life insurance policies, tips for financial planning, or industry insights. It’s all about personal touch; slicing up your email list based on what your clients are interested in lets you email them with material that really speaks to them.

Tools like Mailchimp or Constant Contact are great for managing and segmenting email lists, offering templates and analytics to track the effectiveness of your campaigns.

eBooks, webinars, and guides can position you as an expert while getting leads to engage. You can use calls to action (CTAs) in your emails to direct readers to your website, sign up for a webinar, or download resources, effectively funneling them into your sales process.

Regularly sending out value-packed emails lets you cultivate bonds with potential clients and lays a sturdy groundwork for future customers.

5. Start A Referral Program

Starting a referral program is a smart move to boost your life insurance leads.

First, establish a system where your current clients can effortlessly refer their friends and family to your services. The key here is simplicity – make the referral process straightforward and hassle-free.

Then, motivate participation by offering perks like discounts or rewards for each referral clients send your way. This could be in the form of discounts, rewards, or exclusive benefits for each successful referral they make.

But don’t just stop there. Actively encourage your clients to spread the word. Regularly send them emails or newsletters, kind of like gentle nudges about the benefits they could receive.

Give your fans shareable materials about your business so they can easily spread the word and send you more leads. By making it as easy as possible for your customers to refer, you’re more likely to see more life insurance leads come through.

6. Attend Networking Events

Attending networking events is another highly effective strategy.

Networking events are perfect for meeting potential clients and other business leaders in your area.

When you’re at these gatherings, don’t hold back – jump right in and make things happen. Have a clear elevator pitch ready that succinctly explains what you do and the value you offer in the life insurance domain. Make sure your pitch is snappy, sticks in their mind and sparks interest.

But it’s not just about talking; it’s equally important to listen. Building connections is a give-and-take process, so the connections you make should feel genuine and reciprocal.

After the event, reach out to the contacts you’ve made with a personalized message. This could be a simple email, a LinkedIn connection request, or even a phone call.

Your mission? Keep the dialogue buzzing and subtly convert these new contacts into possible customers. By consistently attending networking events and building a robust network, you’ll significantly expand your reach and potential client base.

7. Bid On Google Ads

Google Ads Pay-Per-Click (PPC) is a potent tool for generating life insurance leads, but it can be expensive.

When picking out keywords for life insurance, balance both general and more specific terms. Broad terms could include “life insurance,” “family protection,” or “financial security.”

More customized keywords, such as “affordable life insurance” or “life insurance for parents,” could be effective if they reflect what you’re offering. Location-focused keywords can also be really helpful.

8. Conduct An Online Seminar

Webinars provide a distinctive opportunity to engage with prospective leads, giving you the chance to explore a range of topics related to life insurance, engage in interactive Q&A sessions with attendees, and impart important knowledge.

Consider hosting webinars on subjects like “Life Insurance Options for Small Business Owners” or “Understanding Life Insurance for Retirement Planning”, for example.

Partner up with other firms or groups to promote your webinars, as this can significantly expand your audience and attract more potential clients.

9. Boost Your LinkedIn Following

Building a solid LinkedIn presence as a life insurance agent involves strategically sharing a mix of educational posts, industry updates, and client success stories. By creating a following, the hope is that life insurance leads will eventually come to you.

As well as decoding industry news and providing updates, you should keep your audience in the loop with the latest news from the insurance world and hot market insights.

Use client success stories show how you’ve really helped people. Sharing real stories about how you’ve helped clients in the past makes your services feel more personal and builds trust by showing actual examples of your skills in action.

10. Partner With Financial Advisors

Partnering with financial advisors is another surefire way to generate a steady flow of life insurance leads. First off, scope out nearby financial advisory firms and pitch a partnership that clearly shows how joining forces can be beneficial for both parties. Strive to craft life insurance plans that sync with the distinct goals and aspirations of their clients.

You can host workshops together on matters like Wills or estate management, and maintain regular communication with your financial advisor partners to keep them informed about new life insurance products and regulatory changes. Not only does this strategy help you tap into a wider audience, but it also amps up the quality of service for everyone involved.

11. Attend Community Events

Attending and participating in community events can offer a fantastic opportunity to connect with potential clients in a more personal and engaging way.

By setting up a booth at a local fair or festival, you can meet individuals and families in a relaxed, community-focused setting. Here, you can have casual yet informative conversations, answer questions, and hand out brochures or business cards. Doing this not only gives your services a human touch, but also lets you directly grasp what your community worries about and needs.

Think about ramping things up a notch by planning or teaming up to give educational talks at places like community hubs, libraries, or local business gatherings. You can tailor these workshops to touch on a variety of subjects that resonate with your audience.

For example, you could run a session on ‘Estate Planning 101’ for an older demographic looking to understand how life insurance plays into their legacy planning.

Another idea could be teaming up with local shops or respected figures in your community for joint events, letting you tap into their existing networks and earned trust.

12. Go Back To Snail Mail

Even in the digital age, direct mail remains a surprisingly effective method for generating leads in the life insurance industry. Sending tailored letters, leaflets, or postcards to prospective clients can capture attention in a way that digital ads often don’t. These hard copy mailers give a real-life connection, reaching customers at the perfect time.

Personalizing these mailings with the recipient’s name or tailoring the content to their potential needs can significantly increase engagement. For instance, a brochure explaining the benefits of life insurance for new homeowners could resonate well with individuals who recently purchased a property.

13. Purchase Leads For Life Insurance

As well as generating your own leads, you can also buy leads for life insurance.

Buying life insurance leads from a trusted source means receiving information about customers who have agreed to be contacted by a life insurance agent already, usually having filled in a form online.

The lead would usually arrive in your CRM or email account, quickly after the user requests more information. However, buying leads can be a straightforward way to grow your customer base without needing extensive digital marketing knowledge.

Companies like Simply Online Leads, Lead Pronto or Service Direct offer life insurance sales leads just like this, for a fixed cost per lead. It’s possible to buy exclusive, non-exclusive, term life insurance leads and many more.

14. Build Your Customer Reviews

Leveraging online reviews is a crucial strategy to boost your life insurance lead generation game. Actively encouraging satisfied clients to share their positive experiences on platforms like Google My Business, Yelp, and industry-specific review sites can significantly bolster your online reputation.

Reviews from happy customers describing how you found the perfect life insurance for their situation can convince potential clients way more than traditional ads. A detailed review outlining how you helped a family find the right life insurance plan can be far more convincing than traditional advertising.

15. Launch A Podcast

Diving into the world of podcasts can be a game-changer for life insurance agents looking to expand their lead generation avenues.

Starting your own podcast can offer a unique platform to share insights, discuss industry trends, and connect with a broader audience. You could host episodes that delve into topics like the basics of choosing a life insurance policy, the importance of life insurance in financial planning, or interviews with experts in related fields like estate planning or financial advisors. This not only establishes your authority in the field but also allows you to tap into the podcast’s growing audience who are interested in financial wellness and planning.

Alternatively, appearing as a guest on established podcasts that cover finance, insurance, or even broader topics like personal growth and entrepreneurship can be incredibly beneficial.

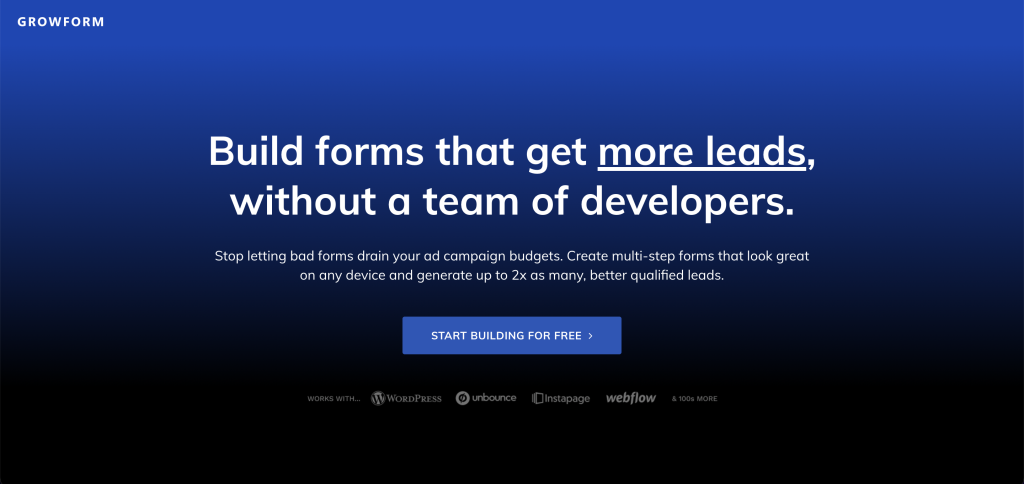

16. Get More Leads With Growform

In the competitive world of life insurance, every website is a potential lead.

But with shortening attention spans and mobile screen-time on the rise, you’re competing for your users’ attention more than ever.

A long, boring form that asks for too much information upfront quickly turns users away, hammering your lead volume and wasting your ad spend in the process.

This is where Growform steps in:

Growform isn’t just another form builder – it was built from the ground for lead generation. It uses conversion rate optimization best-practices, UX research and psychological principles to get you more leads.

With Growform, your users are never greeted with a boring wall of questions.

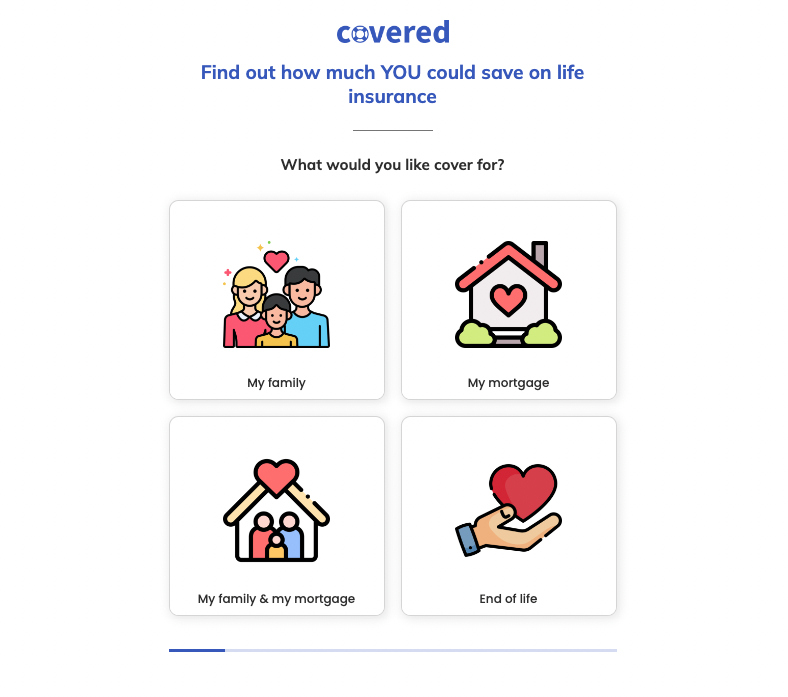

Here’s what a Growform form for a life insurance company looks like:

By splitting up questions onto multiple steps and asking them in an engaging way, you’ll be on the way to capturing twice as many leads from the same traffic.

It’s easy to embed a Growform form into any page of your website, and the tool can send leads pretty much anywhere via Zapier.

Life insurance companies and lead generation experts worldwide use Growform to squeeze more leads from their landing pages, qualify their leads better and keep track of what’s working. Try a 14 day free trial, with no credit card required!